This trend toward disintermediation increasingly is requiring people to decide how much to save and where to invest, and during retirement, to take on responsibility for careful decumulation so as not to outlive their assets while meeting their needs. Today, by contrast, Baby Boomers mainly have defined contribution (DC) plans and Individual Retirement Accounts (IRAs) during their working years. 1 At the same time, changes in the pension landscape are increasingly thrusting responsibility for saving, investing, and decumulating wealth onto workers and retirees, whereas in the past, older workers relied mainly on Social Security and employer-sponsored defined benefit (DB) pension plans in retirement.

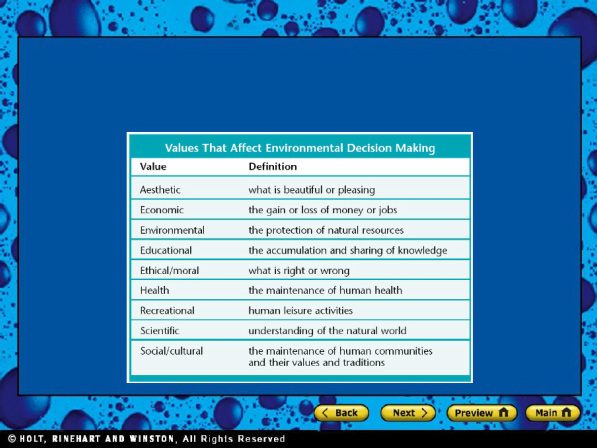

Alternative financial services, including payday loans, pawn shops, auto title loans, tax refund loans, and rent-to-own shops have also become widespread. People who had credit cards or subprime mortgages were in the historically unusual position of being able to decide how much they wanted to borrow. At the onset of the recent financial crisis, consumer credit and mortgage borrowing had burgeoned. Learning to make these decisions off of comprehensive, well understood and trustworthy data can drastically increase the effectiveness of any decision and bring order to an otherwise chaotic world.įorbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives.Financial markets around the world have become increasingly accessible to the ‘small investor,’ as new products and financial services grow widespread. Making informed, objective decisions can eliminate uncertainty on correct choices and often guarantee the best possible outcomes. Healthy skepticism and asking if there is a conflict of interest can expose early on whether a data set is purely analytical or might be inaccurate and skewed.ĭata is one of the most valuable resources in the world.Īlmost half of the top seven biggest companies in the world use data as their primary product for good reason. Most brokers provide access to financial data, but often there is a conflict of interest, such as a broker selling their own stock, or fees on trading either explicit or invisible through slippage.įor this reason, it’s essential to carefully evaluate the trustworthiness of data sources and not take information at face value, especially when critical decisions are being made from it. The solution is to find data sources that are fundamentally incentivized to provide accurate data. The commonality from all three of these is a fundamental agency problem each of these groups stood to gain financially from manipulating their data or failing to correct incorrect data. Far from novel, these are just several examples of data being difficult to trust. Recently, payment for order flow was popularized, selling people’s trades to big institutions and allowing them to take profit away from investors. In the wake of the LIBOR scandal, cracks in the financial system were exposed and the underbelly of market manipulation was revealed. One of the largest crypto data providers revealed that 65%-95% of all their data was inaccurate and untrustworthy. This paradigm is far from original, with many of the most prominent data sources using citations and best practices to try to eliminate the uncertainty. Combined with visualizations, it can form a complete picture for faster understanding and superior intuitive answers. Data in isolation is hard to understand intuitively and even worse to try to act upon. One of the best ways to use data is not as a standalone item in a complex sheet but as a living, breathing, dynamic guide for making better decisions.

Being able to process this information is knowing not just what the words mean, but also how it affects a company and how it compares to other similar companies. Financial data is rife with jargon and acronyms that require a dictionary to read, let alone understand. Likewise, it’s almost impossible to rationalize numbers without context for what they mean.

It’s difficult to visualize two numbers of orders of magnitude apart, but it’s easy to see how big one circle is against another. Data explanation and visualization is a crucial component of understanding complex data points.įinancial data is infamously one of the largest data sets in the world and endlessly complicated, so seeing it in easy-to-process graphs instead of raw metrics helps elucidate.

0 kommentar(er)

0 kommentar(er)